Unser Angebot

für die Versicherungs- und

Finanzdienstleistungsbranche

Unsere Kompetenzen – Ihr Mehrwert

Wir sind eine Unternehmensberatung mit Schwerpunkt auf die Versicherungsbranche. Unsere Mitarbeiter sind Aktuare, Versicherungsfachexperten, Business Consultants und IT Architekten.

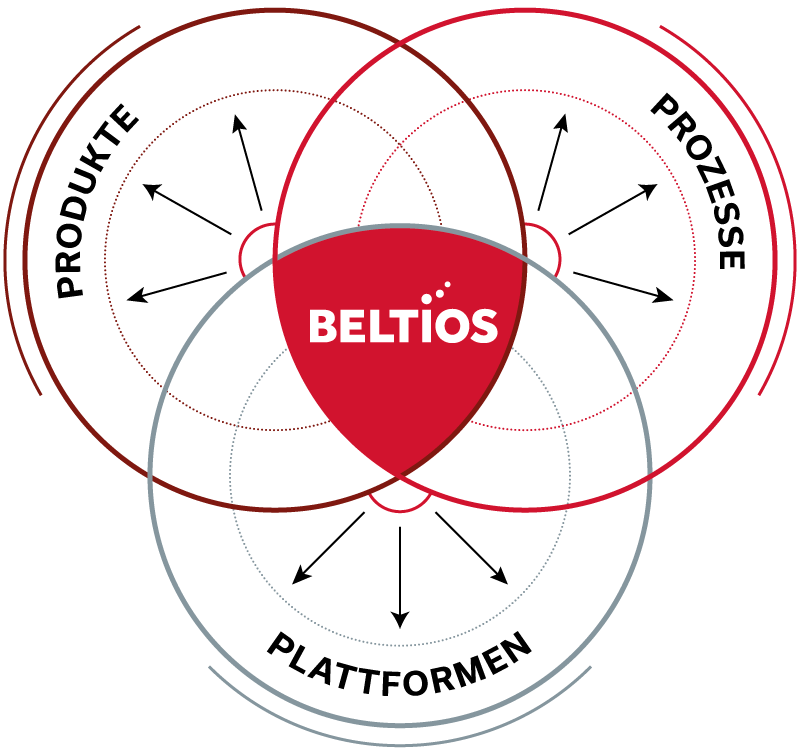

Wir bündeln unsere Kompetenzen bedarfsorientiert und bieten unsere Beratungsleistung innerhalb dreier wesentlicher Dimensionen an: Produkte, Prozesse und Plattformen.

Wir integrieren Fachexpertise, Methodenkompetenz und IT Knowhow zu einem Angebot, das in Deutschland einzigartig ist. Unser Ziel ist es, unsere Position als eine der führenden Unternehmensberatungen für die Versicherungsbranche im DACH Raum weiter auszubauen.

Das erreichen wir indem wir in unsere Mitarbeiter und Kompetenzen investieren, unsere Leistungen kontinuierlich verbessern und einen messbaren Mehrwert für unsere Kunden erbringen.